Legal Accounts Payable Software

Simplify Accounts Payable Workflows with Automation

Streamline your law firm’s Accounts Payable processes with automation features to help automate payment entry, calculate discounts, and much more.

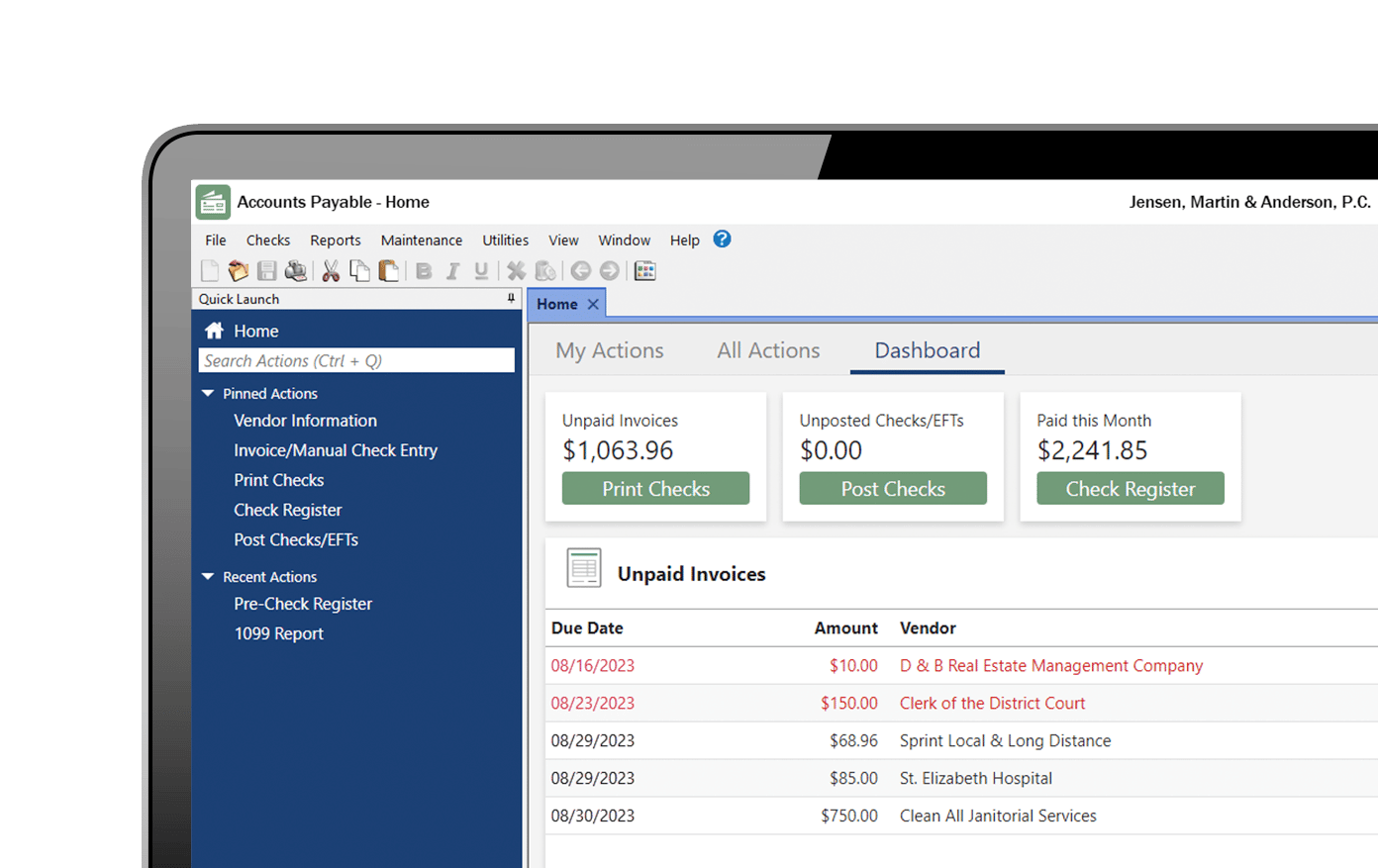

Tracking Made Easy

Using the Tabs3 Accounts Payable Dashboard, you can easily see any unpaid invoices as well as totals for unpaid invoices, unposted checks, and the amount paid this month, all at a glance.

Print Checks Based on Your Needs

Print a batch of checks or use the Print Check feature to print a single check. Record handwritten checks. Print memos on checks and more.

Stay Secure with Positive Pay

Accounts Payable includes a Positive Pay Export program that allows you to export a list of all approved checks that can then be uploaded to your bank or financial institution’s fraud prevention program.

File 1099s Quickly and Easily

Print 1099 forms and combine amounts paid to vendors and Trust Accounting payees to meet IRS thresholds.

FAQ

What is Accounts Payable automation?

Accounts Payable automation (or AP automation) refers to technology that simplifies the accounts payable process by utilizing automated workflows. As a result, AP automation can significantly reduce and, in some cases, eliminates the need for repetitive manual tasks like creating and submitting recurring invoices which can be time-consuming. Note, however, that automation does not entirely take over your accounts payable processes.

How does Accounts Payable's automation features benefit law firms?

By adopting automation features in accounts payable, law firms can expedite the invoicing process, maintain compliance, lower costs, and reduce the risk of human error. Additionally, it enables law firms to manage their expenses more effectively and obtain valuable insights into their cash flow that can inform their decision-making. These features are especially helpful when entering recurring invoices or check requests.

Does Tabs3 Trust Accounting Software provide me with 1099s for tax reporting?

Yes, 1099s can be prepared either by your Firm as a payer, or by the Trust Account holder as payer. When your firm is the payer, 1099 information can be combined with your accounts payable information to create a combined 1099 form or electronic file.

Read more: Prepping for Tax Season: Form 1099 Basics for Law Firms

Can Tabs3 Accounts Payable Software automate our firm’s recurring payments?

Yes. Tabs3 Accounts Payable Software can memorize recurring payments and automatically enter them to save you time.

Will Tabs3 Accounts Payable Software keep track of discounts?

Yes. Discounts can automatically be calculated when the invoice is entered in Tabs3 Accounts Payable Software.

Can Tabs3 Accounts Payable Software estimate cash requirements for an upcoming month?

Yes. Both Detail and Summary Cash Requirement reports are available in Tabs3 Accounts Payable Software.

Can I put an invoice on hold so it doesn’t get paid while I dispute something on the invoice?

Yes. Tabs3 Accounts Payable Software allows individual invoices to be placed on hold.